Morgan Stanley Online Tax Center

Welcome to the Morgan Stanley Online Tax Center. The Morgan Stanley Online Tax Center provides you with the information that you need to prepare for this tax season. Click on any of the links below to view the details.

Online Access of IRS Forms 1099

1099 Consolidated Tax Statements will become available on Morgan Stanley Online in three separate waves

- 2/8/2017

- 2/22/2017

- 3/7/2017

If you elect to receive paper documents they will be mailed according to the same schedule. Clients who receive 1099s for accounts in an account linked group will have their 1099s processed together in the latest wave for which any account in that group was scheduled. Please review the Guide to Your 1099 Consolidated Tax Statement for additional information.

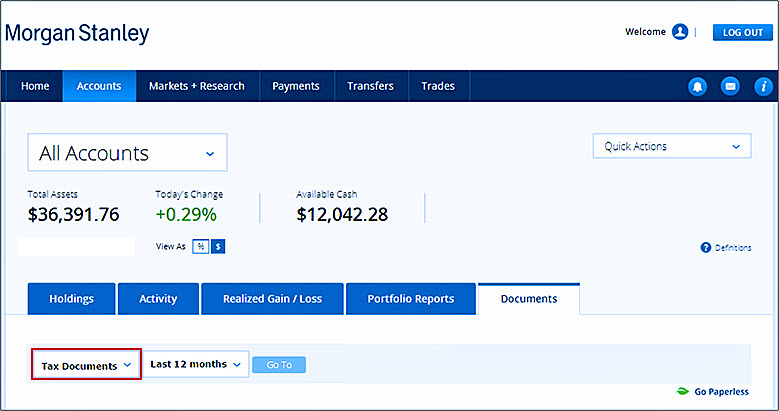

To access your 1099s:

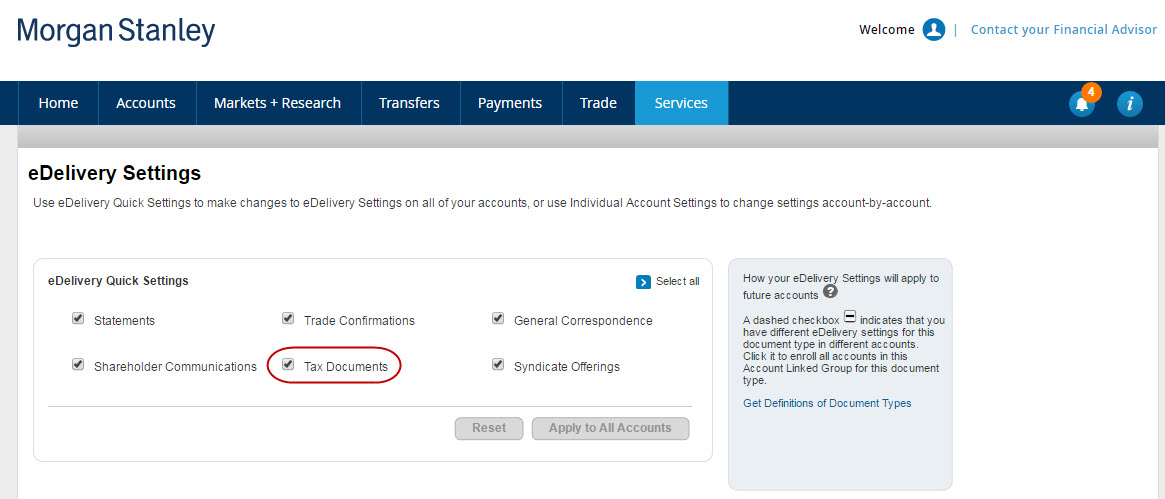

Get your Tax Documents Faster by Enrolling in eDelivery

Make sure you are notified as soon as your Tax Documents are available by enrolling in eDelivery.

-

Click here to enroll in eDelivery now

-

Once enrolled, you will be notified via email when your tax documents are available

-

You can still access your tax documents online if you are not enrolled in eDelivery

Realized Gain/Loss Data

View your Realized Gain/Loss Data Online.

-

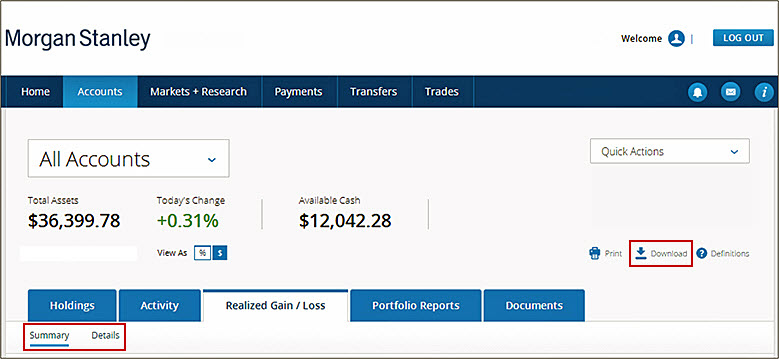

Go to the Accounts menu and select Realized Gain/Loss

-

Access your Realized Gain/Loss Summary and Realized Gain/Loss Details by switching views

-

Download your Realized Gain/Loss data by clicking “Download” icon

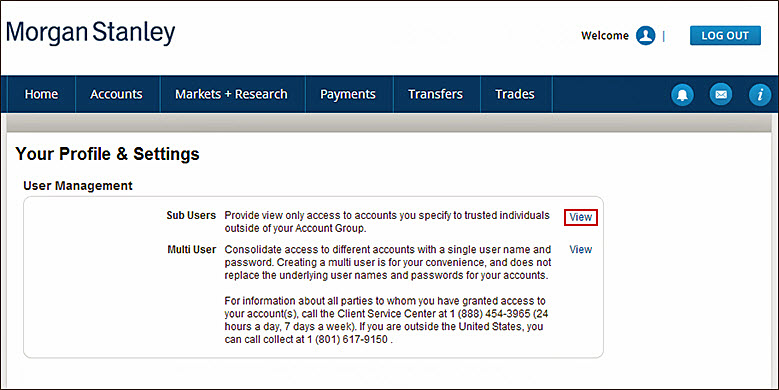

Third Party Access (Sub User)

Provide view only access to your account(s) to third parties.

Tax Preparation Software

You can download tax information to the following products.

-

TurboTax

-

H&R Block Tax Software. Click here for H&R Block discounted rates

-

LaCerte

-

ProSystem fx

For Additional Assistance

Get additional help if you need it.

-

Click the  icon to access Help + Support

icon to access Help + Support

-

If you need assistance, please contact your Financial Advisor or the Client Service Center at 1 (888) 454-3965 (24 hours a day, 7 days a week). If you are outside the United States, you can call collect at 1 (801) 617-9150

Morgan Stanley Smith Barney LLC (“Morgan Stanley”) and its Financial Advisors and Private Wealth Advisors do not provide any tax/legal advice. Consult your own tax/legal advisor before making any tax or legal-related investment decisions.

The tax preparation software services referenced herein are provided by unaffiliated third parties. Neither Morgan Stanley nor its affiliates are the provider of such services and will not have any input or responsibility concerning a client’s eligibility for, or the terms and conditions associated with, these services. Neither Morgan Stanley nor its affiliates shall be responsible for content of any advice or services provided by any unaffiliated third party referenced herein.

CRC 1682627 01/2017